|

Hey! You there! Yes you! Are you past your prime, a self-proclaimed business mogul, considerably wealthy, yet still chasing that American dream as if you aren’t? Well, I have the perfect business proposition for you! Allow me to introduce The Corrupt Institute of Money-Making! A place where spry senior citizen business majors can make their millions and win accolades while they're at it. At the institute, we pride ourselves on providing an unobstructed path for true leaders to live up to their fullest potential… Profit potential, that is! With thousands of offices across the USA, we’re never out of reach, and by utilizing the cutting (emphasis on cutting) edge of financial investments, we can guarantee the success of every one of our members. What is this investment? Higher education of course! You see, higher education is quickly becoming the time investment for prospective CEOs, Presidents, and Imperators. This is especially the case in our arts-focused ventures. A stigma already exists around these areas that a career is next to impossible. This stigma protects us from being held liable for failing to deliver on any perceived value. By promising value that is not easily qualifiable, we can charge exorbitant fees with no way of being held accountable by our customers. It’s a winning sales strategy! Our members see an immense accumulation of wealth during their time here, and can expect an energizing and brief tenure before moving to one of our other offices. Oh, what’s that? You’ve never taught at a school before? No? You’ve never been at a school before? Ah, not to worry! The actual running of the school has very little to do with what you’ll be up to! And as much as we offer superficial input from our students and staff, the board is actually who is responsible for hiring you. Look around, and I think you’ll find there’s many familiar faces ; ) shouldn’t give you any trouble. So, what will you be up to? Upon joining our lovely institute, the first thing you’ll want to do is get the money flowing! Did you know that many of the faculty members at this school actually make a living off this? Off teaching? I know, ridiculous! Some of them teach music theory, some composition, and even others teach piano! You might be thinking, piano?! That’s not even an orchestral instrument! What an astute eye and brain for business you have, you’re clearly in the right place! Long story short, these are incredibly costly positions, a real drain on our resources. Easy way to generate a lot of revenue quickly is to cut them. Done! Look at that, the school is doing great now! Once you’ve cut away all the unnecessary teaching/staff positions from the school (it’s really just fat anyways) feel free to take a little cash for yourself! Think of it as a bonus for all the hard decisions you’ve been making! After all, without you, that surplus would never have existed, and we can’t have people thinking we have enough to hire some new teachers, or even worse, offer raises. You see now? This is profitable! I will admit, the job’s not all sunshine and rainbows. At times it can be a profound struggle. Sometimes staff members don’t want to leave, they have a family to support, they have a mortgage, need to pay bills, they come up with the wildest excuses. You may find that administrative holes will open up in the school where students' needs “aren’t being met sufficiently,” I wouldn’t call it that, but fair enough. Let’s say you want to solve that problem for some reason. How do you go about it? It’s kind of a trick question. Do nothing.

Let me explain. The beauty of our model is that once we have attracted a customer, otherwise known as a student, we have attracted an investor. The students, drawn in by our wonderful marketing, have now invested a considerable sum into their education with us. This means they have a vested interest in the functionality of the school, because that’s what they’ve paid thousands for. They can’t leave because they’ll have wasted their money, and they can’t let the school collapse for the same reason. So if nothing is done to fix whatever problems occur, what will happen? The students will fix and fill these holes themselves. Best part? We don’t have to pay them for this work. They pay us. If any teachers choose to help out their students, we don’t have any obligation to compensate them for that. Brilliant, isn’t it? What’s wrong? You look worried. What if teachers and students get upset? Oh, such a pessimist! Very well, in that case the best policy is to ignore them too. Other than talking to you, they have no way of politically or legally addressing their concerns with you, so it’s best not to listen. If you never apologize, you never did anything wrong. Ignoring can be done by simply never answering them--this can often be enough. Or, point them to someone else for answers. Should you find yourself in a position where students and staff are pestering you incessantly with the nitty-gritty of running or leading the school, you can hire an administrative assistant. Assistants are superbly adept at soaking up any issues that are distracting you from your goals here. The best part is that they cost a fraction of what a faculty position would. The only down-side is that they need to be replaced rather frequently. They have a habit of breaking down. Worst case, most of the faculty and staff, excluding you of course, are on single year contracts. This makes removing the more stubborn problems very simple. We pay our courier handsomely for this explicit purpose! One last thing before you take your new position, I want to make clear that you should only be coming to our institute with the intention of making money. School stopped being about education a long time ago.

0 Comments

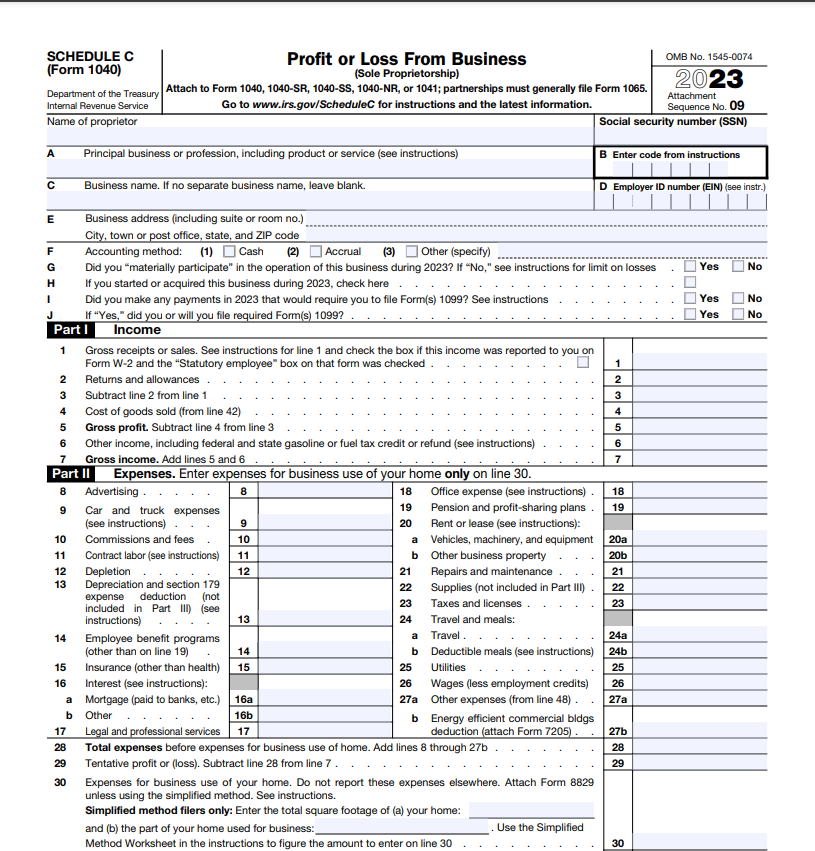

Well, it’s that time again! Time to see if you’ve been keeping track of all the documents you needed amidst a whirlwind of a year. It’s tax season. I realize this might not be the most interesting topic for a blog, but I figured I’d lay out my process for filing taxes as a musician/composer in case anyone is trying this process out for the first time! Ideally this would be something every music curriculum would cover… but here we are. Before we begin, I'd like to just clarify that I am not a tax professional. This post is intended to be a starting point in your taxation endeavors, a way to connect you to resources. I hope you find it helpful! The centerpiece of a self-employed composer or musician’s taxes is the Schedule C, a form that you will need to fill out to report your income and business expenses. In this post, I’ll walk through what you’ll need to do this successfully, and explore some options for where to do it. What to Keep Track of:The most important thing to do is to keep track of all the money you made over the course of the year. Any time you get paid, record the amount somewhere. You should include a description of who paid you for what services and the date you received the money. This will make your life incredibly easy by the time tax season rolls around. I promise without this list you will not remember what happened last month, let alone last year. This should also include any prizes or award amounts (yes, you have to pay taxes on that too!) and royalties paid to you by your PRO (this is specific to composers). Oftentimes you will receive tax forms, especially if you’re playing gigs. You should still record the income from these, but make sure to mark on your list that you have an accompanying form. Put these forms into a safe place to return to when it’s time to file. I keep a physical folder marked with the tax year. In addition to income, you’ll want to keep track of all the money you spent in the process of carrying out your musical business. These will make up your “business expenses” which you can play against your income to hopefully reduce the amount of taxes you are expected to pay. Just like the income, make sure to add a descriptor of the payment and the date you made it, and make sure you keep all of these receipts. You could simply toss them into the same folder you put your other tax forms. Many people are surprised by what they can classify as an expense. If it was something that helped you in the process of making music, it can often be counted. Anything from gas mileage to a gig, to music you purchased from a composer, to cane for reed making, to even concert tickets (technically research for your craft!) can be counted as a business expense! If you want to do the math, you could even claim a portion of your rental expenses if you use a portion of your apartment for business (definitely run this by a tax preparer to ensure it is calculated correctly). If you do this right, you should be asked to pay next to nothing when you’re just starting out, and will most likely be eligible for a refund (yay!). If you have any questions about a specific scenario, feel free to comment below or reach out to me directly. I’m happy to help to the best of my ability! How to Keep Track:Ultimately this is up to personal preference, but I’ll give you a run down of how I do it–it’s pretty simple. I use two methods in conjunction. The first is a simple list on the notes app on my phone. I have a different one for each year, which is laid out like this: 2023 Business Income: Paid: (List of all paid income along with descriptors and dates) Planned: (List of all contracted work that hasn’t been paid yet) Business Expenses: (List of all money I spent in the process of running my business, again including a descriptor and the date I paid it) Donations: (Any donations I made to organizations over the course of the year, yes this is often a write-off too!) Royalties: (Any money I made from my PRO (ASCAP)--this is more for me to not forget to pull the 1099-MISC from their website or grab it out of my physical file) Year Summary: (This is where I total up my income and my expenses to get an idea of how I did for the year) In addition to the list, I also use a spreadsheet to help with budgeting throughout the year. This can be helpful to double check your numbers too. Google has an amazing budget template that I use and highly recommend, complete with a fancy line graph to make your terrifying deficit at least look pretty! You can find it if you go to “My Drive”, “+ New”, and then hover over the arrow next to “Google Sheets” and click “From a template”. You’ll find it in there labeled “Annual budget”. There’s lots of options so feel free to peruse the others! Where to File:Filing can be daunting the first time you do it. That is by design, as big companies like TurboTax make a lot of money through the horror stories of paying taxes. You probably have heard some of these legends of the great test of paying taxes, even good ol’ Benjamin Franklin compared it to death in its inevitability… I promise it isn’t as bad as you think. First mistake to avoid is using TurboTax. It’s stupid expensive for no reason–even worse for a musician like you, they charge extra for those of us who are self-employed. Diabolical. I’ve recently been exploring low cost options and decided to use FreeTaxUSA. It’s almost honest with its name, you still need to pay $15 to file state taxes, but that’s much better than the hundreds they try to get out of you with TurboTax. If you end up with a tax refund like myself, you can use it to mitigate the cost. I enjoyed using it. It was simple and had a good layout for reporting specific expenses. One take away I would add from the experience is that you should break down your itemized list of expenses and organize what you can into the larger categories they provide on their site. This will let you keep track of what expenses you counted as part of “Travel”, “Office Supplies”, etc. MyFreeTaxes also seems like a great option that I’m looking to try next year. It is completely free. As always, I’ll report back! Another free option is available with VITA or TCE sites. These are centers in place to assist people with filing their taxes. They often provide in person assistance, and sometimes offer drop off sites where they will file on your behalf. They are intended for people who make less than $64,000 per year, have disabilities, or are limited-english speaking. You can find one by either looking for it on the IRS website (irs.gov), or you can dial 211 on your phone and ask, "where can I get my taxes done for free?". Filing:Quick aside about filing quarterly: You’ll hear a lot of people recommend that you file quarterly if you run your own business. This is good advice, but I’ve found it doesn’t always apply to us, especially if we’re just starting to make real money in this career. We really have no way of accurately predicting our annual income, especially at the start. For this reason, I have been filing annually every year. The IRS states that, "Individuals, including sole proprietors, partners, and S corporation shareholders, generally have to make estimated tax payments if they expect to owe tax of $1,000 or more when their return is filed." (irs.gov) If you're not going to owe more than $1,000 on your gigs/composition income, don't stress.

In my case, where I also work a steady job with a W-2, the taxes taken out of my bi-weekly paychecks already end up balancing out anything I would owe. My self-employed income alone is not enough to warrant a tax of $1,000 or more. Once you have a stable studio as a teacher, or start making a larger income in general, it will be easier to calculate approximately how much money you might make over the course of the year. When this happens, it'll be time to look into filing quarterly. I'll likely try it out this coming year and report back. I'll link a guide like this one here, when I do! Okay back to the yearly file: Before you get to the Schedule C, you’ll be asked to enter other personal information, and input information from any W-2s or 1099s you received from all the work you did/gigs you played. For composers, this is where you’ll put your 1099-MISCs from your PRO (ASCAP/BMI/SESAC). If you’re self-published, you’ll receive two of these, one as a writer/composer, and one as a publisher. You should report these two separately here. Once you get to the Schedule C, some sites will prompt you to connect some of those 1099s you submitted earlier to your business income, if it does, do this. Royalties for composers and musicians go here. Then proceed to input all the other info you will have hopefully saved in your list and spreadsheet. There will be one section for income and one for expenses. Before you know it, the hard part will be over. After answering a few more questions and filing state taxes, you’ll be done! Again, feel free to reach out if you have any questions. Good luck, Godspeed, thanks for reading, and happy jamming!

I was engaging in the wonderful (soul sucking) world of Instagram the other day, and I scrolled to a disturbing piece of news. An account by the name of @laura_horowitz_narrator was claiming that Spotify had just updated its terms of service on its audiobook distribution platform, Findaway Voices. After looking into it more, I was shocked to find that it was true. The terms, "required authors using Findaway's services to grant Findaway and Spotify rights to 'translate, modify, [and] create derivative works' from submitted audiobooks. The terms further stipulated that Spotify could use the audiobooks (termed 'user content') in 'training' and 'modeling' in connection with Spotify services." (authorsguild.org) Scary.

Luckily, Spotify has since decided to revise these terms. However, I believe this has very much to do with the backlash more than anything else. Had people not spotted the change, I think it would still be in place. "The new terms remove the rights to 'translate' and 'creative derivative works' from the grant of rights, make the grant of rights revocable by the authors, and further make it explicit that the grant of rights does not authorize Spotify to use user content to create new ebooks, audiobooks, or use it for voice narration AI training." (authorsguild.org)

The thing that really scared me most about this prospect is the potential for this rights abuse to be complimented through the use of AI. The generative process that AI uses is still notorious for its often comical flaws and inability to create complicated original ideas that hold water. However, imagine if it was able to be fed existing works to base its creations off of? In the case of fiction writing, it could be provided with a fully flushed out world, and even entire plot lines. In that case, all the AI would need to do is to create something derivative--a much more manageable task. This could essentially cut the writer fully out of the creation process. With the terms they had originally stipulated, it would be legal. Imagine the horror of spending years crafting an entire world only to have it stolen by a faceless corporation. Reading words that wouldn't exist without you, but that you have no control over. You could watch your own work rise to prominence with absolutely nothing to show for it. Yikes!

Now it's true that this ended up not being the case, and there is an argument to be made that something like this could be contested in higher courts, even if it is stipulated in terms of service. For musicians, this might even seem like a distant issue, we don't do audiobooks, we make music! Yet, I think it's important to think of the arts as a collective whole. When a portion of us suffers, we all suffer. Such a potential loss of rights in the writing field sets a precedent that would surely come to haunt us shortly after. It's by standing together that we have a chance to prevent abuses like this. Even so, this fiasco isn't so important in terms of its direct impact, but more for its spotlight on the psyche of the folks running Spotify. This platform is currently not here to help us. As much as they insist otherwise, it's here to profit off us and cut us out at the first chance it gets. I want to dig into just how harmful it is, and how helpful it could be. Streaming Royalties:

If you look up how Spotify decides what artists get paid, you'll be pointed to a couple of very neat and polished looking videos. They feature that loveable AI DJ voice we all care for so much, describing how the sausage gets made amidst a collage of colorful and creative animations. Except, this doesn't actually tell you how things get calculated. It leaves the question of why royalties are so low for streaming to the vague notion of distributors and publishers impacting this. In fact, they really throw them under the bus quite a bit. While yes, this can definitely impact the royalties that an artist might receive, it isn't the full story.

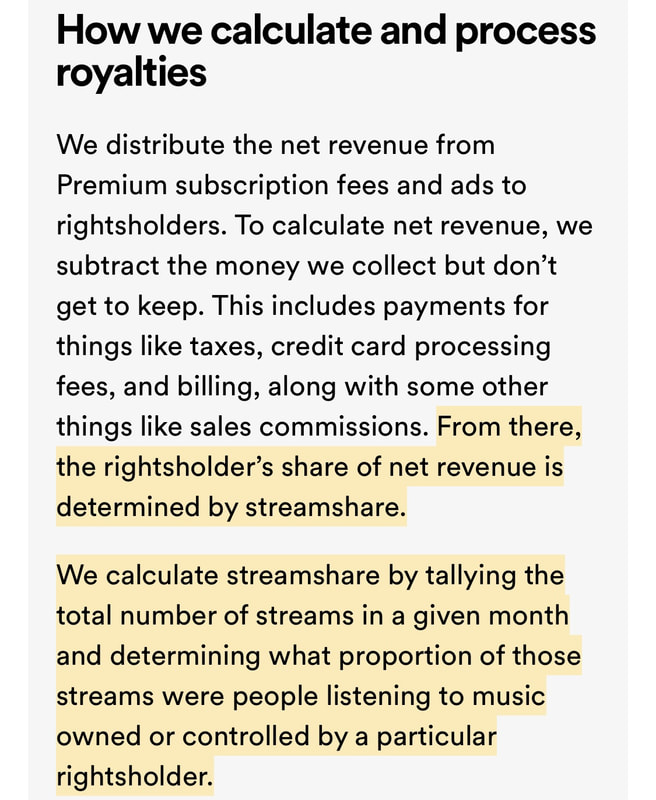

The video above is missing a little term called "streamshare" which is used by Spotify to describe the amount of streams that a given distributor received through their artists over the duration of the month. When Spotify looks to pay musicians, it looks at the total number of streams and then the total number of artists and divies up a percentage of the total amount of revenue earned (Spotify claims this is 2/3rds of every dollar of revenue) amongst their rights holders (distributors, publishers, etc.). This essentially creates a system in which only artists with a massive following who can take up the biggest percentage of the total stream pie will see any kind of substantial income through streaming royalties. For example, because Taylor Swift might be getting millions of the billions of total streams while smaller artists may only be getting in the hundreds, Swift could get over $100 million in streaming royalties for her massive percentage of streams, leaving the smaller artist with pennies, if that. This rubs me the wrong way, especially because hundreds of streams is nothing to scoff at!

Another Way?:

I've been contemplating solutions to this problem over the last few months. After discussing with friends and colleagues (special thank you to Immanuel Mellis and Finn Penzo), I think the best system we've been able to dream up is one in which royalties are paid on an individual consumer basis rather than a percentage of total streams. Here's an example comparing the current system with the proposed solution:

Willy pays $10.99 every month for Spotify Premium. A fan of Taylor Swift, they streamed her music 76 times over the course of the month. Willy also streamed the music of their struggling musician friend, Sean, 24 times. Under the current system, that $10.99 would be collected, a portion would be used to pay taxes and expenses, and then 2/3rds would be put into a pool of revenue to be distributed to artists based on a percentage of the total streams that month. This means that it doesn't really matter that Willy was only a Swiftie for 76 percent of the month and a good friend (I'm kidding) the remaining 24 percent. The total streams Taylor Swift received would drown out Sean's considerably smaller audience and that would be reflected in the royalty distribution. But what if that wasn't the case?

Under this proposed concept, Willy would pay their $10.99 every month, but instead of that money being thrown into a pool after expenses are paid, it instead stays with Willy's listening stats and is distributed that way. After taking that 1/3rd out for taxes and expenses, we're left with $7.32. 76 percent of that goes to Taylor, so $5.56. Then 24 percent goes to Sean, $1.75! You might be thinking, that's barely $2, so what? But I'm thinking that's almost $2! For 24 streams! What?!

​

I love this concept for two reasons: it would increase small artist revenue considerably (which would actually benefit their distributors and publishers as well, as they'd be the first to see that money--something I might want to discuss in a later post), and it would create a direct way for fans of an artist to support them, just by listening! Whenever I'd stream my favorite artists, I would know exactly where my money was going. It'd let me support them in a way that was tangible for both myself and them. Powerful stuff. Yes, this would cut into the millions that Swift and other big artists make off Spotify, but I think it's a small price to pay to ensure another revenue stream for aspiring artists.

What are your thoughts? Would this system work? Why or Why not? I'd love to hear from you! Thank you for reading, and happy jamming! |

AuthorSean Penzo is a composer, cellist, and writer currently based in Pittsburgh, PA Archives

July 2024

CategoriesHeader photo by Peter Kleinau on Unsplash

|

RSS Feed

RSS Feed