|

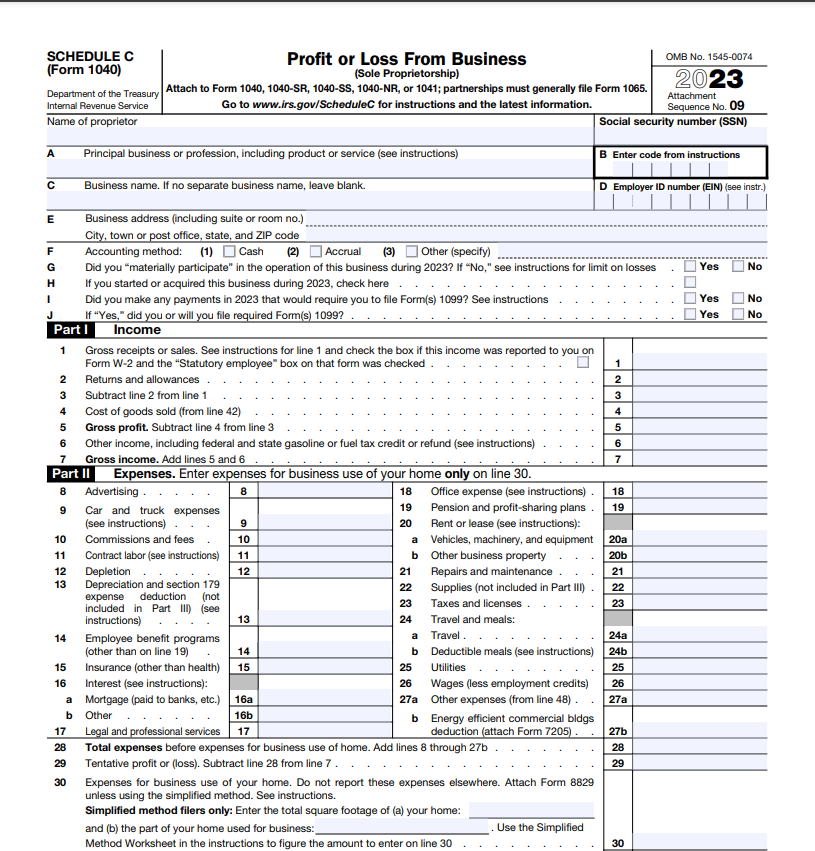

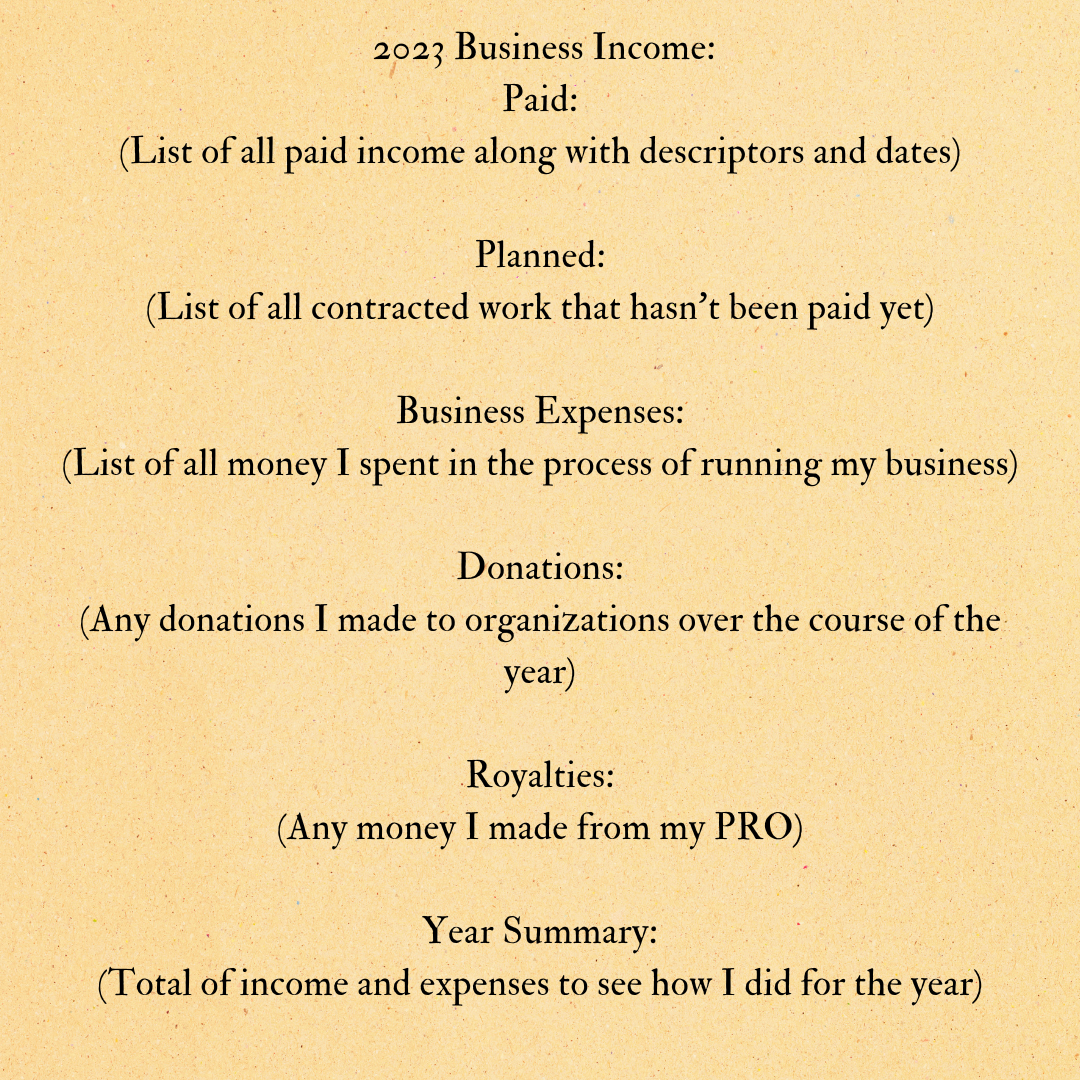

Well, it’s that time again! Time to see if you’ve been keeping track of all the documents you needed amidst a whirlwind of a year. It’s tax season. I realize this might not be the most interesting topic for a blog, but I figured I’d lay out my process for filing taxes as a musician/composer in case anyone is trying this process out for the first time! Ideally this would be something every music curriculum would cover… but here we are. Before we begin, I'd like to just clarify that I am not a tax professional. This post is intended to be a starting point in your taxation endeavors, a way to connect you to resources. I hope you find it helpful! The centerpiece of a self-employed composer or musician’s taxes is the Schedule C, a form that you will need to fill out to report your income and business expenses. In this post, I’ll walk through what you’ll need to do this successfully, and explore some options for where to do it. What to Keep Track of:The most important thing to do is to keep track of all the money you made over the course of the year. Any time you get paid, record the amount somewhere. You should include a description of who paid you for what services and the date you received the money. This will make your life incredibly easy by the time tax season rolls around. I promise without this list you will not remember what happened last month, let alone last year. This should also include any prizes or award amounts (yes, you have to pay taxes on that too!) and royalties paid to you by your PRO (this is specific to composers). Oftentimes you will receive tax forms, especially if you’re playing gigs. You should still record the income from these, but make sure to mark on your list that you have an accompanying form. Put these forms into a safe place to return to when it’s time to file. I keep a physical folder marked with the tax year. In addition to income, you’ll want to keep track of all the money you spent in the process of carrying out your musical business. These will make up your “business expenses” which you can play against your income to hopefully reduce the amount of taxes you are expected to pay. Just like the income, make sure to add a descriptor of the payment and the date you made it, and make sure you keep all of these receipts. You could simply toss them into the same folder you put your other tax forms. Many people are surprised by what they can classify as an expense. If it was something that helped you in the process of making music, it can often be counted. Anything from gas mileage to a gig, to music you purchased from a composer, to cane for reed making, to even concert tickets (technically research for your craft!) can be counted as a business expense! If you want to do the math, you could even claim a portion of your rental expenses if you use a portion of your apartment for business (definitely run this by a tax preparer to ensure it is calculated correctly). If you do this right, you should be asked to pay next to nothing when you’re just starting out, and will most likely be eligible for a refund (yay!). If you have any questions about a specific scenario, feel free to comment below or reach out to me directly. I’m happy to help to the best of my ability! How to Keep Track:Ultimately this is up to personal preference, but I’ll give you a run down of how I do it–it’s pretty simple. I use two methods in conjunction. The first is a simple list on the notes app on my phone. I have a different one for each year, which is laid out like this: 2023 Business Income: Paid: (List of all paid income along with descriptors and dates) Planned: (List of all contracted work that hasn’t been paid yet) Business Expenses: (List of all money I spent in the process of running my business, again including a descriptor and the date I paid it) Donations: (Any donations I made to organizations over the course of the year, yes this is often a write-off too!) Royalties: (Any money I made from my PRO (ASCAP)--this is more for me to not forget to pull the 1099-MISC from their website or grab it out of my physical file) Year Summary: (This is where I total up my income and my expenses to get an idea of how I did for the year) In addition to the list, I also use a spreadsheet to help with budgeting throughout the year. This can be helpful to double check your numbers too. Google has an amazing budget template that I use and highly recommend, complete with a fancy line graph to make your terrifying deficit at least look pretty! You can find it if you go to “My Drive”, “+ New”, and then hover over the arrow next to “Google Sheets” and click “From a template”. You’ll find it in there labeled “Annual budget”. There’s lots of options so feel free to peruse the others! Where to File:Filing can be daunting the first time you do it. That is by design, as big companies like TurboTax make a lot of money through the horror stories of paying taxes. You probably have heard some of these legends of the great test of paying taxes, even good ol’ Benjamin Franklin compared it to death in its inevitability… I promise it isn’t as bad as you think. First mistake to avoid is using TurboTax. It’s stupid expensive for no reason–even worse for a musician like you, they charge extra for those of us who are self-employed. Diabolical. I’ve recently been exploring low cost options and decided to use FreeTaxUSA. It’s almost honest with its name, you still need to pay $15 to file state taxes, but that’s much better than the hundreds they try to get out of you with TurboTax. If you end up with a tax refund like myself, you can use it to mitigate the cost. I enjoyed using it. It was simple and had a good layout for reporting specific expenses. One take away I would add from the experience is that you should break down your itemized list of expenses and organize what you can into the larger categories they provide on their site. This will let you keep track of what expenses you counted as part of “Travel”, “Office Supplies”, etc. MyFreeTaxes also seems like a great option that I’m looking to try next year. It is completely free. As always, I’ll report back! Another free option is available with VITA or TCE sites. These are centers in place to assist people with filing their taxes. They often provide in person assistance, and sometimes offer drop off sites where they will file on your behalf. They are intended for people who make less than $64,000 per year, have disabilities, or are limited-english speaking. You can find one by either looking for it on the IRS website (irs.gov), or you can dial 211 on your phone and ask, "where can I get my taxes done for free?". Filing:Quick aside about filing quarterly: You’ll hear a lot of people recommend that you file quarterly if you run your own business. This is good advice, but I’ve found it doesn’t always apply to us, especially if we’re just starting to make real money in this career. We really have no way of accurately predicting our annual income, especially at the start. For this reason, I have been filing annually every year. The IRS states that, "Individuals, including sole proprietors, partners, and S corporation shareholders, generally have to make estimated tax payments if they expect to owe tax of $1,000 or more when their return is filed." (irs.gov) If you're not going to owe more than $1,000 on your gigs/composition income, don't stress.

In my case, where I also work a steady job with a W-2, the taxes taken out of my bi-weekly paychecks already end up balancing out anything I would owe. My self-employed income alone is not enough to warrant a tax of $1,000 or more. Once you have a stable studio as a teacher, or start making a larger income in general, it will be easier to calculate approximately how much money you might make over the course of the year. When this happens, it'll be time to look into filing quarterly. I'll likely try it out this coming year and report back. I'll link a guide like this one here, when I do! Okay back to the yearly file: Before you get to the Schedule C, you’ll be asked to enter other personal information, and input information from any W-2s or 1099s you received from all the work you did/gigs you played. For composers, this is where you’ll put your 1099-MISCs from your PRO (ASCAP/BMI/SESAC). If you’re self-published, you’ll receive two of these, one as a writer/composer, and one as a publisher. You should report these two separately here. Once you get to the Schedule C, some sites will prompt you to connect some of those 1099s you submitted earlier to your business income, if it does, do this. Royalties for composers and musicians go here. Then proceed to input all the other info you will have hopefully saved in your list and spreadsheet. There will be one section for income and one for expenses. Before you know it, the hard part will be over. After answering a few more questions and filing state taxes, you’ll be done! Again, feel free to reach out if you have any questions. Good luck, Godspeed, thanks for reading, and happy jamming!

0 Comments

Leave a Reply. |

AuthorSean Penzo is a composer, cellist, and writer currently based in Pittsburgh, PA Archives

July 2024

CategoriesHeader photo by Peter Kleinau on Unsplash

|

RSS Feed

RSS Feed