|

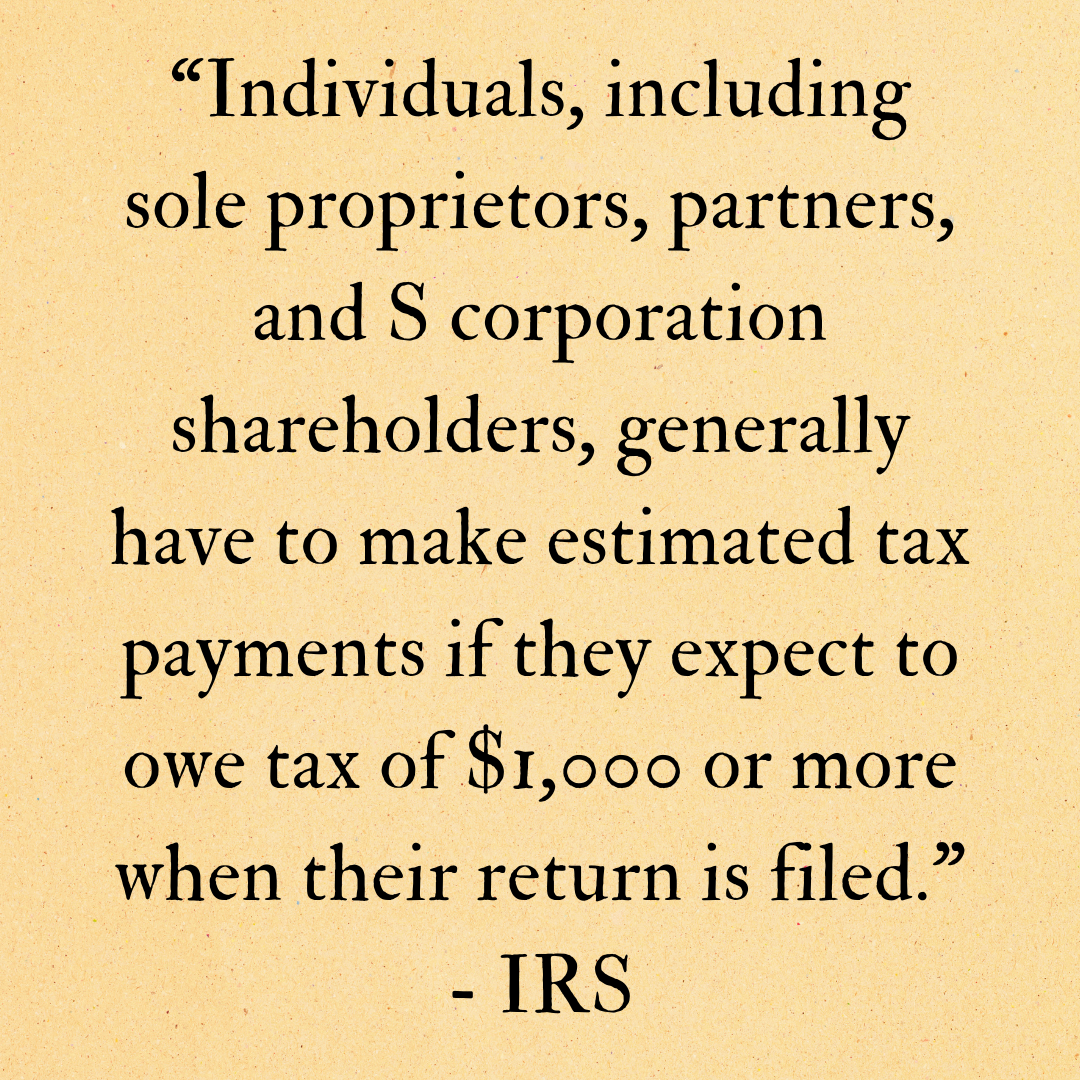

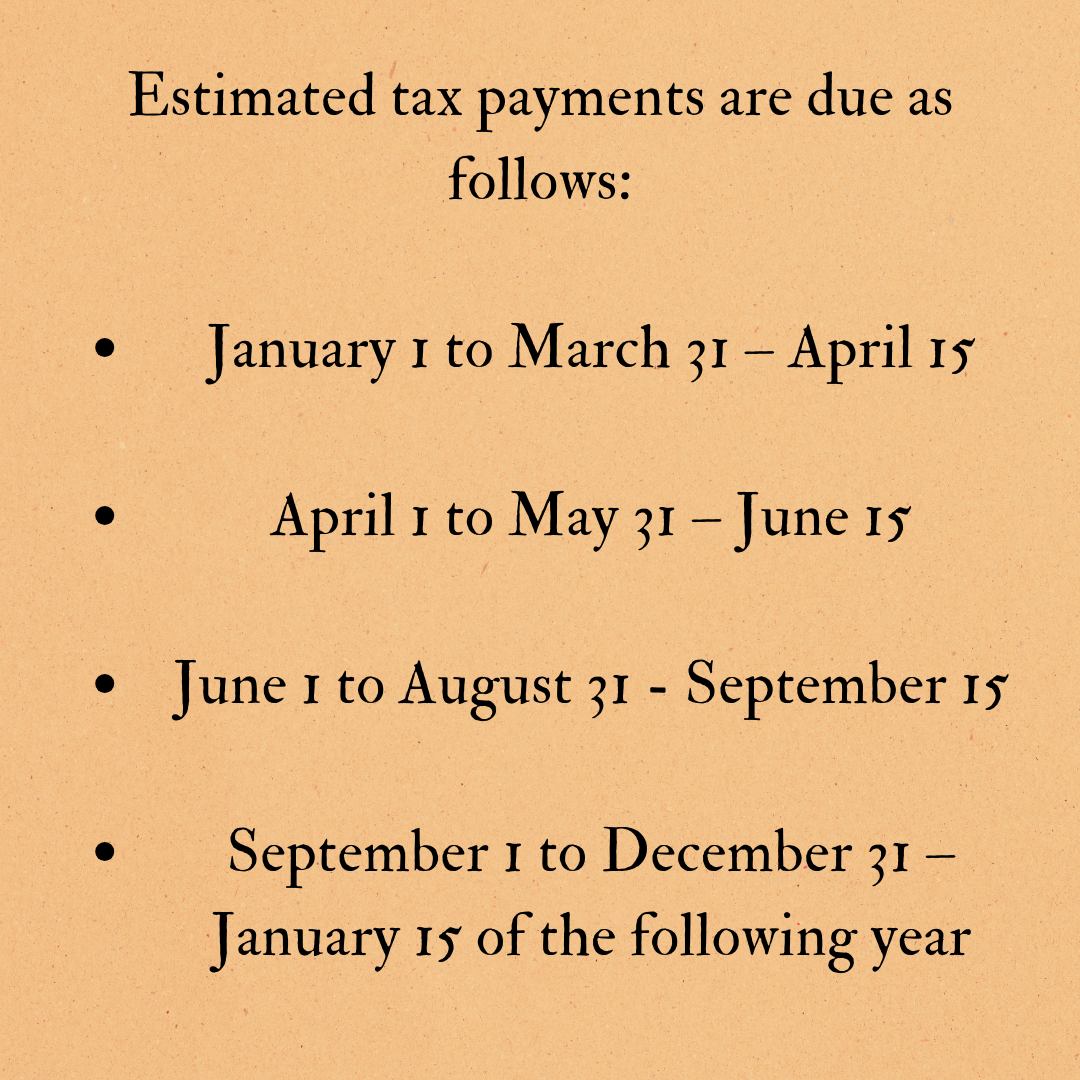

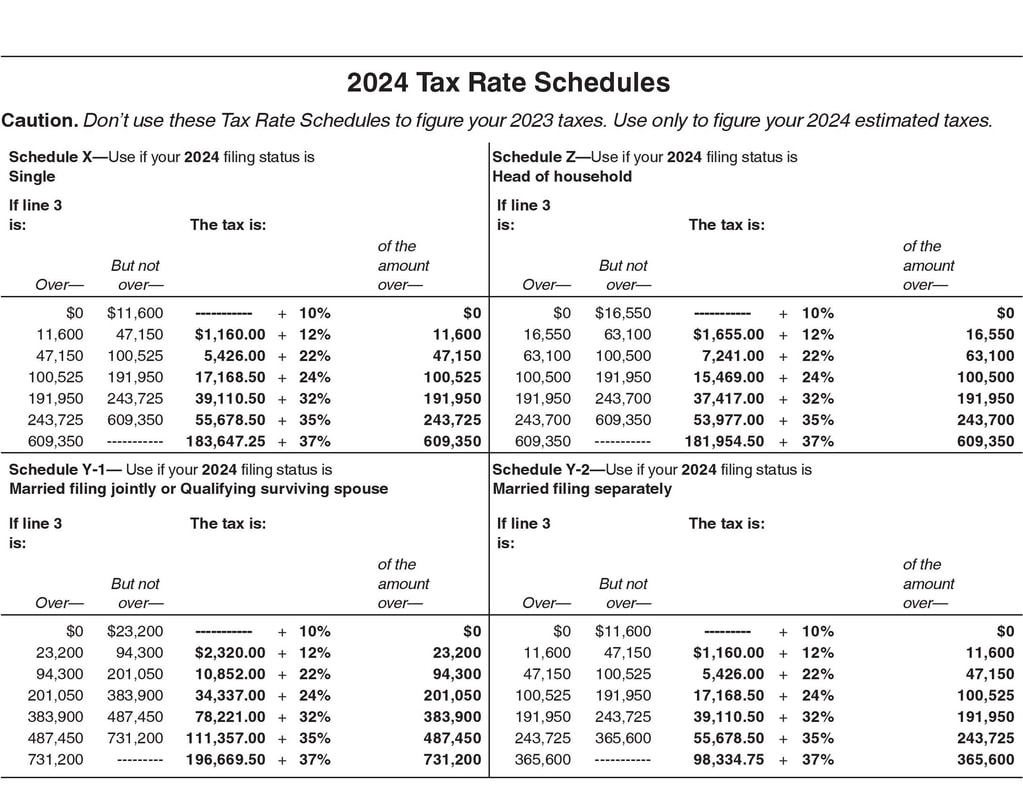

As a follow up to my previous post, “Filing Taxes as a Musician” I thought I’d do another one focused around how to file quarterly. If you're a gigging musician, a studio teacher, or a composer, it's something you'll need to do eventually! It may seem like filing taxes quarterly would be daunting, especially with how complicated regular filing can be made out to be. However, to my surprise, and maybe yours, it’s quite simple. Whether you’re just embarking on this process or simply need a reminder, I hope you find this post helpful. I am not a tax professional. This post is just a run down of how I go about things. Think of it as a starting point in your taxation adventures–a way to connect you with helpful resources. Also please make sure to refer to the tax forms for the year you are filing. The information can change from year to year, and so some of the rates I use in my examples may be out of date after 2024. Do I Need to File Quarterly?Not all self-employed workers are required to pay quarterly taxes. As the IRS states, “Individuals, including sole proprietors, partners, and S corporation shareholders, generally have to make estimated tax payments if they expect to owe tax of $1,000 or more when their return is filed.” (irs.gov) A good way to check this is to look at your expected income, subtract all business expenses, and then roughly determine the amount of tax you would need to pay on the net amount. (I’ll do a run down on the math for that below). What is a Quarter?If you’ve found that you will likely owe $1,000 or more, you’ll need to know when to file quarterly. A quarter refers to one quarter of the full year. This means you’ll need to make your estimated payments four times per year. The chart below lays out the range of the quarters along with when the deadlines are for each of them: How Much Do I Pay?When filing quarterly, you’ll want to make sure that you don’t underpay. Failing to pay quarterly when you need to, or underpaying too much can result in penalties and fees. So how do you avoid this? As a composer or a musician, you will very likely have no clue how much money you’ll be pulling in for the year. Gigs can come and go, and royalty income isn’t exactly the most stable thing in the world. When how much you need to pay depends on how much money you’ll be pulling in for the year, this can get rather confusing. Don’t worry! For those of us in the precariat, there’s a lovely thing called “safe harbor”. Essentially, this rule allows those of us who are unsure of how much we’ll make in the coming year to avoid penalties by referring to our previous year’s tax return. “Generally, most taxpayers will avoid this penalty if they owe less than $1,000 in tax after subtracting their withholdings and credits, or if they paid at least 90% of the tax for the current year, or 100% of the tax shown on the return for the prior year, whichever is smaller.” (irs.gov) So when I figure out how much I’m going to pay quarterly for this year, I refer back to my previous year’s tax return. That’s right! Save these! I find how much my net income was for last year and I calculate the amount of tax I would owe. To do that, you should refer to the Form 1040-ES for the current year you are filing. You can find this by simply googling “Form 1040-ES” along with the current year. On this Form there will be a “Tax Rate Schedules” chart that looks like this: This chart gives a rundown of how much money each tax bracket needs to pay on their net income. For example, for the year 2024, you would refer back to your 2023 tax return. If you made between $0 and $11,600 you only need to pay 10% of that amount in taxes. So, if your net income was $10,100, you pay $1,010. If it was $11,300, you pay $1,130. This gets a little funky if you move up a tax bracket. If you make $20,000, you will still be taxed at that 10% rate, but only for the first $11,600. After that, you would owe 12% on the remaining $8,400. This means you would pay a total of $2,168 on that $20,000 of net income. Once you have the total minimum taxes you’ll need to pay for the year, divide that number by four, and voila you have your quarterly payment amount. I like to add a little extra to this amount, especially if I’m anticipating that I’ll be making more this year. There is no penalty for overpaying, only underpaying. Additionally, any amount you paid over will be returned to you by the end of the year, so there’s really no reason not to add a little extra to soften the blow at the end of the year. Worst case, if you make a large amount more than expected, you’ll owe a little extra by the end of the year. However, by following the “safe harbor” rule, you should be protected from any fees or penalties. How Do I Pay?Actually paying the quarterly amount is quite simple and can be done online for free. Here’s a step by step list on how to go about it:

1. Go to https://www.irs.gov/payments/direct-pay and click, "make a payment". 2. Select “estimated tax”, “1040”, and whatever the current year is. 3. Insert identity verification information (this tax year doesn’t matter. Pick as close to current as possible so you can refer to your return for that year to accurately fill in the info). 4. Calculate how much you owe. Use the method I detailed above if you’re unsure of how to do this. 5. Please remember that you need to do this for state taxes as well! This will likely be different from the federal filing. Many states offer their own online portals for doing this. In PA, it’s called myPATH. Keep in mind, the tax rate and threshold will be different depending on where you are filing, so check the forms specific to that state. 6. After putting in your payment information, you’re done! I would save a PDF of your receipt and write down the amount you paid in your records so you have it by the end of the year for regular filing. And that’s it! If you have any issues or questions, feel free to reach out. I’m always happy to help to the best of my ability. I highly recommend looking for a VITA site near you if you want assistance with your taxes. You can find one by either looking for it on the IRS website (irs.gov) or you can dial 211 and ask, "where can I get my taxes done for free?". Good luck, Godspeed, thanks for reading, and happy jamming!

0 Comments

Leave a Reply. |

AuthorSean Penzo is a composer, cellist, and writer currently based in Pittsburgh, PA Archives

July 2024

CategoriesHeader photo by Peter Kleinau on Unsplash

|

RSS Feed

RSS Feed